[Editor’s note: Due to the long lag in reporting sales information by many retail and shoe firms, we are beginning a new approach with this report. As soon as trade statics are available, we will issue a report on them. We will later provide a full review of the sales data when theybecome available in month or two.]

US Economy Growing Slowly; Hiring Under Performing; Full Year Outlook Better

US Economy US gross domestic product grew at an anemic 0.5% in the first quarter of 2016 with job increases only about 160,000 in two of the four months through April, well below the over 200,000 per month job grow average of 2015.

Sales Data: Early Look

• We expect this to be confirmed by more first quarter sales data from the retail and shoe firms which data will be released over the next 45 days.

o Sales seem to be weak overall, except for athleisure items especially from brand powerhouses like Nike and Under Armour.

o Reporting to date for the first quarter of 2016, Under Armour up 30%, Skechers up 27%, Adidas up 17% while Steve Madden was up only 1.7% and Wolverine World Wide declined 8.5%.

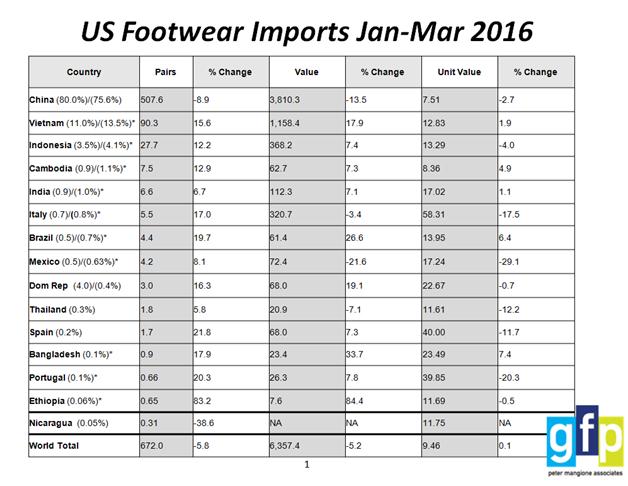

US Sourcing Update

• Imports of footwear into the US in the first three months of 2016 were down significantly: overall minus 5.8% in pairs. The decline was entirely due to an 8.9% drop in shoes from China, whose market share in pairs declined to 75.6%, down from 80% in the same period in 2015.

o The total market fell by 41.1 million pair while shoes from China fell by 62.5 million pair.

o Increases were recorded by Vietnam (up 12.1 million pair), Indonesia (up 3 million pair), while all the others combined to record an increase of more than 6 million pair.

• On pricing, average cost was flat overall.

o Big declines were reported for imports from Italy, Spain and Portugal: due no doubt to the double digit appreciation of the dollar against the euro in 2015 when these imports were priced. (Since January 1, 2016, the dollar has given back about half of this appreciation against the euro: it also has lost about 11% against the real, against which it had appreciated by some 40% in 2015.)

• On leather footwear, the story was much the same: the market fell 10.3% by some 14.3 million pair in the quarter, with China declining by some 15.8 million pair with small declines also reported by Indonesia, Mexico and Nicaragua. China’s market share in pairs in the US for the first quarter fell from 62.4% in 2015 to 56.8% this year.

o Gains were noted for Brazil, Spain, Cambodia, Portugal, Bangladesh, Italy and Ethiopia, with small gains for Vietnam, India, and the Dominican Republic.

US Imports of Leather Goods – China Continues to Dominate Shoes, Apparel, Gloves and Bags But Less So than in the Past

• Leather imports in general also fell sharply into the US in the first quarter of 2016.

o As noted, overall leather shoe imports fell in dollar terms by 10.6% for the quarter and those from China fell by even more by 18.9%.

o Apparel declined by even more, dropping 12.5% overall and China falling 24.5%.

o Same with gloves: down 28% overall and China down 36.6%

o Accessories did better falling only 0.4% but declined by 14%.

o Overall, China’s leather imports into the US in the first quarter of 2016 fell by 19.5%.

• Finished leather imports, mostly from Mexico for the auto sector, also fell by 8.3% although China’s tiny share remained flat.

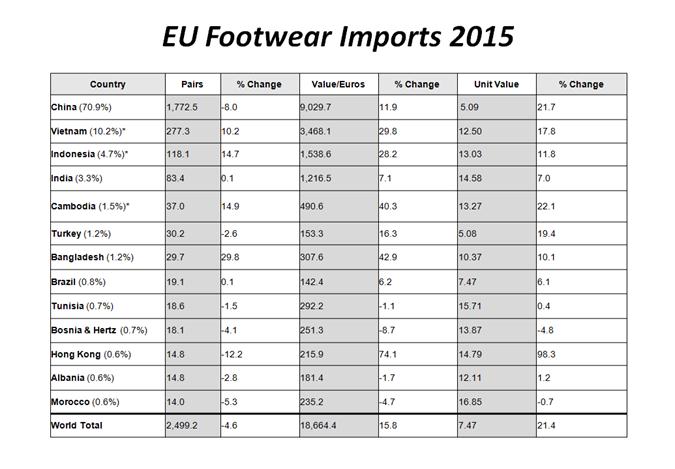

EU Footwear Imports Decline in 2015

• Overall, shoe imports into the 28 countries of the EU fell by 4.6% in pairs to 2,499.2 million pair in 2015. Overall decline was 93.3 million pair from 2014.

o The entire decline was accounted for by China, down 8% or some 148.7 million pair less than in 2014.

o Small declines were also recorded from Turkey, Tunisia, Bosnia, Hong Kong, Albania, and Morocco.

o Big increases came from Vietnam, Indonesia, Cambodia, and Bangladesh.

o Average prices on shoes from China were up 21.7%, from Vietnam up 17.8%, etc.

o Price increases were modest from countries with currency tied more closely to the euro like Tunisia, Bosnia, etc.

• Imported prices were up sharply especially from countries whose currency is related closely to the appreciating dollar.

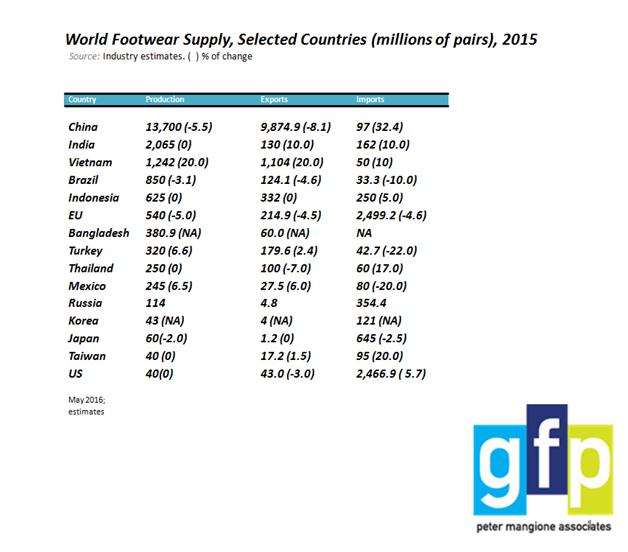

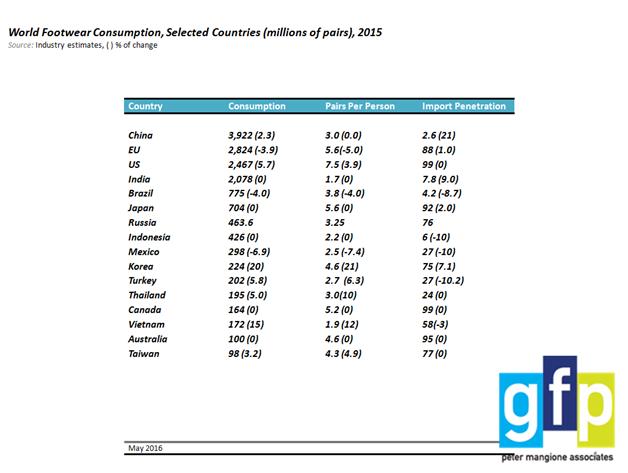

World Footwear Supply and Consumption 2015

• The big news in global shoe trade in 2015 was the huge decline in shoe exports from China, down over 850 million pair, about the entire shoe production of Brazil or three times that of Mexico. Much of the decline was seen in the major markets like the EU (down 148 million pair) and it is starting to show up in US figures with China shoe imports down by some 62.5 million pair in the first quarter of 2016.

• At the same time, Vietnam increased its exports and production by some 20% with exports estimated to top 1.1 billion pair in 2015, still only about 11% of China’s shoe exports.

• On the consumption side, the largest increase for 2015 was in the US which reportedly experienced an increase of some 5.7%; other sources state the increase in consumption in the US for 2015 at about 4%. The torrid pace of sales of the hot athleisure brands is the driving force and is likely to continue in 2016.

Peter T. Mangione, Global Footwear Partnerships LLC, Washington, DC, May 10, 2016, ptmangione@gmail.com, Copyright@Global Footwear Partnerships LLC. All rights reserved. No reproduction without written permission